NAVIGATING BANKRUPTCY REMOTENESS: MECHANISMS AND PITFALLS

By: Vaidehi Gulati*

Abstract

I. Introduction

The process of declaring bankruptcy for an entity exists globally especially in situations when it finds itself unable to service its financial liabilities or preserve the value of the assets. In case the business of the entity is not viable, its assets are quick utilisation for the benefit of the creditors. Such a process increases the ability of business to successfully fund itself where the interest of the investors is also preserved. Allowing an entity to declare insolvency / bankruptcy is critical to foster a healthy business environment. Across the globe different countries have melange of statutory legal requirements for the same. However, when the failure of one entity begins to impact other related entities, causing a cascading effect, it is always a best practice to build procedures that limit such an impact. One invaluable method of achieving this goal is through isolation of assets / bankruptcy remoteness through securitisation but this has its own weaknesses which causes the objective of isolation of assets and funding to fail. Establishment of an SPV or entities under securitisation are constantly subject to certain limitations and risks. Bankruptcy proof and bankruptcy remoteness, both the concepts are essential in protecting the interests of investors and the entity’s assets from the uncertainties associated with bankruptcy. The concept of bankruptcy proof evaluates the vulnerability of assets that may be subject to bankruptcy proceedings, on the other hand, bankruptcy remoteness focuses on isolating financial transactions or entities from the risk of bankruptcy of other stakeholders.

II. Understanding securitisation, SPV and bankruptcy remoteness

There are several advantages of securitisation for originators:

- Conversion of illiquid assets to cash.

- Efficient access to market.

- Raising capital.

- Generate earnings.

- Transfer of risks to third party.

Examples of securitisation service providers are as under:

- Servicer

- Trustee

- Investment banks.

- Rating agencies.

- Tax and auditing advisers.

- Legal advisors.

- Asset managers.

Securitised assets by collateral type:

- Auto

- Collateralised debt obligations

- Consumer loans

- Equipment leases

- Ships/Aircrafts

- Trade receivables

- Student loan etc.

In India, the High-Level Committee on Corporate Debt and Securitisation (Chairman: Dr. R. H. Patil) in 2005, made recommendations which paved the way for the development of the corporate debt and securitisation market. In February 2006, the Reserve Bank of India (RBI) issued guidelines for securitisation of standard assets by Banks, FIs and NBFCs. Several recommendations of the High-Level Committee were also accepted by RBI. The amendment to the Securities Contracts (Regulation) Act 1956 in 2007, to include “securitised instruments” in the definition of “securities”, helped in listing and trading of securitised debt on stock exchanges3. Securitisation helps to avoid the mark-up charges of the middleman of funds and also enables the company to raise capital inexpensively. The principal documents in a securitisation transaction typically include assignment agreement though in India, the general requirements foe securitisation has been prescribed for securitisation of standard assets4.

Special Purpose Entity and Special Purpose Vehicles and bankruptcy eligibility

A special purpose entity (SPE) 5 or special purpose vehicle (SPV) is a creature of securitisation. The SPE is created for a specific purpose. In several commercial transactions, it is preferred to establish an SPV as a subset of SPE to create insulation/ isolation from the financial and operational risks of the Originator. An SPV is an off-balance sheet vehicle (OBSV) comprised of a legal entity created by the originator (typically a major investment bank or insurance company) for fulfilling a temporary objective of the Originator.

The key to successful establishment of an SPE/SPV is by following the ‘separate legal entity principle’6. The purpose of SPE/SPV should be set out in the memorandum of association and it should enjoy all the typically attributes and benefits associated with legal separateness. The Supreme Court7 has also held that an incorporated company has a legal existence and identification of its own, having assets, liabilities and powers which are distinct from its members’. The existence of the separate legal entity principle, a corporate veil is created between the corporate entity and the other stakeholders of the company irrespective of the fact that the different corporate bodies are working under a single group company/ economic entity. SPVs allow the investors to access certain investment opportunities which it would not otherwise exist, and it may also provide a new source of revenue generation for the Originator. There are certain basic characteristics that an SPV possesses as compared to a company, for example:

- High level of debt versus equity.

- Incorporated with a limited purpose (mainly securitisation).

- A separate legal entity distinct from any other person or entity.

- Don’t have any employees.

- Memorandum of Association clearly indicates SPV’s objects.

- Does not have any indebtedness other than the loan that is secured by a particular parcel of property.

- The assets acquired from the originator is held by the SPV for and on behalf of the investors.

- Cannot undertake any business other than of holding receivables for and behalf of the investors.8

- Bankruptcy remoteness.

When are SPV/SPE’s required

Establishment of an SPV/SPE can be for wide variety of reasons. The firms/Originators use the SPV/SPE mainly to separate the financing aspect through control rights, on-balance sheet, and off-balance sheet finance decision. Other factors are as under:

- A method of breaking down, the risks associated with a pool of assts held by it.

- To relocate the risks and share the risks from the originator to several investors.

- To purchase rights of claim of the Originator, for securitisation of loans other receivables and to issue highly liquid securities to finance their purchase.

- For financing a project or raising capital at more favourable borrowing rates and lowering the funding cost.

- To isolate specific groups of assets or cash flows.

- Enables selling the SPV as a self-contained package when an SPV owns some assets which are non-transferable or difficult to transfer.

- The Originator is willing to sell the pool of assets, thereby removing certain toxic assets from its balance sheet, thereby complying the Financial Accounting Standards.

- In cases when the Originator intends to avail tax benefits.

In short, the goal of the Originator in making a separate legal entity, is to make it bankruptcy proof, to serve specific economic goals without taking over the complete liability of the debts or the risks associated with it.

Legal forms/structure of SPV

The structure or the form of an SPV differs depending on the jurisdiction of its incorporation, the legal structure and on the objective, requirement for establishing it of the originator. An SPV may be established in the form of corporation, trust, partnership, or a limited liability company. The SPV may be a subsidiary of the originator or may be an independent one which is not consolidated with the originator for tax, accounting, or legal purposes. Globally the structure of SPV differs as follows:

- In USA an SPV is established in the form of a limited liability.

- In Canada it is established in the form of charitable trusts

- In Europe an SPV can be established as a limited purpose organisation or as an LLC or as a charitable trust.

- In Australia and New Zealand, the most widely used for of SPE is a trust.

- In India an SPV can take a form a company, limited liability company, partnership, limited liability partnership etc.

- In Argentina SPVs generally are formed as Mutual Funds, trusts or corporations.

- In Morocco, the SPVs can be established in the form of (i)institutional investors in debt (ii) entity which is governed by the legislative or regulatory systems of Morocco or other foreign countries.

The choice of choosing a specific structure of an SPV depends on various factors and criteria like prevailing tax regime, legal regulations, goal of a project and off-balance sheet financing which in variably reduces the burden on the Originator.

Bankruptcy remoteness Vs Bankruptcy proof

Bankruptcy remoteness9 works as long as the entities are not in bankruptcy10. Bankruptcy remoteness means when an asset belonging to a third party, or when an entity is not affected due to the bankruptcy faced by the originator.

For Example: If a company ‘AB’, the vehicle manufacturer issues a securitisation of portfolio of its auto loans and later files bankruptcy, there would be no impact on the securitisation as each auto loan borrower is required to pay in terms of the agreed terms and the collection would act as a cashflow to pay interest and principal on the auto loan securitisation debt.

Taking into consideration the above stated characteristics, SPE, SPV are less likely to become insolvent because of its activities, though these factors do not make it bankruptcy proof or eliminate the risk of bankruptcy. The courts usually pierce the corporate veil for consolidating the Originator and the SPV. The ultimate intention behind formation of an SPV / SPE is mainly to reduce the likelihood of the entity to (a) file a voluntary bankruptcy action (b) become insolvent and (c) have an involuntary bankruptcy action filed against it. In this regard the decision of the Seventh Circuit passed in the matter of Doctors Hospital of Hyde Park, Inc.11 can be referred, wherein it observed that the MMA funding LLC, created to finance purchases of the Doctors Hospital of Hyde Park, Inc’s receivables lacked the usual attributes of a bankruptcy remote vehicle, it was not operating as a separate legal entity and neither was performing activities separately from its originator and neither funding existed.

In some cases,12 SPE / SPV cannot be restricted from seeking protection under the prevailing insolvency and bankruptcy laws in a particular jurisdiction. The bankruptcy courts can force the SPV/SPEs into bankruptcy by merging the entities with other allied estates of the originator/debtor13 mainly to provide remedy to the creditors to adequately distribute the funds.

Essentials of Bankruptcy Remoteness

There are certain legal tests which need to be met in order to establish bankruptcy remoteness:

- The SPV must be an independent entity separate from its Originator.

- The investors should solely with no recourse to the originator, connect with the SPV for payment of interest and principal on their securities.

- Clear distinction between assignment of loan or true sale.14

Should have independent directors, which would in turn reduce the likelihood of the board seeking to commence voluntary insolvency proceedings. In case of corporation,

- It must have an independent board of directors that have fiduciary duties towards the investors and in case of trust, it must be managed by a separate trustee.

- Documents must impose certain corporate governance.

- Requirement of investors approval and from rating agencies for any change in the SPVs originating documents.

- Isolation from substantive consolidation.

- Properly structuring the SPE/SPV to ensure non-inclusion of its financial assets in the bankruptcy estate.

There are other global criteria that have also been developed for an entity to be considered as bankruptcy remote15. In India the SPEs should adhere to the guidelines and criteria for the Originator with respect to securitisation exposures16.

III. Inter-relationship between securitisation, rating, and bankruptcy remoteness

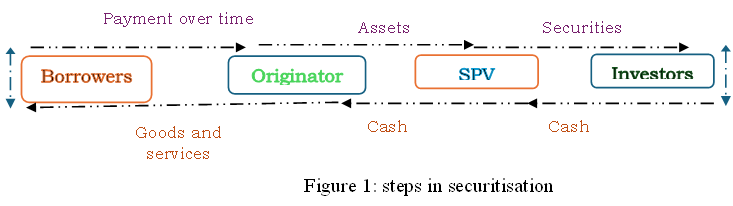

Securitisation is finance mechanism and is dependent on the creditworthiness of the secured assets. Securitizations are “bankruptcy remote,” which means that the fate of the securitization is disassociated from the credit performance of the originator that would set up the securitization. It is an alternative to the conventional issuance of bonds. The process of securitisation is initiated when the Originator or an entity that is in financing need and possesses the appropriate assets for structuring financing and must completely relinquish their ownership and control over the assets.

Securitisation involves three key participants and the process can be divided into two stages-

- first, the business with pool of quality receivables (originator) sells assets/transfers along with its risks and any underlying assets to a bankruptcy remote/free standing special purpose vehicle (SPV), set up for a specific purpose,

- second, repackaging and or selling the tradeable security interests representing claims on incoming cash flows from the asset or pool of assets to the investors. The proceeds are then used to pay the originator for the receivables. Securitisation17 is different from mere balance sheet manipulations18.

Thus, in short securitisation is the process of taking an illiquid asset, or group of assets, and through financial engineering, transforming them into a security19

Securitisation and bankruptcy remoteness are interlinked through their common goal i.e., bankruptcy remoteness. This arrangement gives the investors an undisputable claim over the assets which are collateralised for the securities that are bought by the SPV. For successful securitisation, there are three major functions of SPV in securitisation:

- Acts as a pass-through vehicle – An SPV allows the assets of the Originator to be securitised and sold to the investors.

- Protection against insolvency of the SPV- It is beneficial for the investors of the securitised assets.

- Protects the securitised assets- The assets that are transferred to the SPV creates a barrier for protecting them from the creditors of the Originator.

Rating Agencies and their role.

In the context of securitisation, the major role of the rating agencies is to provide credit rating20 in case the asset backed securities are issued by the SPV. It also assists the investors in making their investment decisions. Efficient and accurate credit rating is essential for SPV as a favourable rating will enable the SPV in attracting investors interest. The credit rating agencies play a crucial and integral role in determining the creditworthiness of the asset backed securities, part of securitisation. They can also impact the price of securities. Credit rating agencies have considerable input with respect the cashflow, risks in the transaction and the legal framework. The rating has implication on the collaterals which could result in losses at the opportune time.

The credit rating however are relative measures of default probability. Credit ratings play a crucial role in securitisation and set a standard in the credit rating business. The CRISIL Ratings21 has developed a framework for evaluating legal risks in securitisation transaction for evaluating the risks that affect the investors. The credit rating by agencies enables the courts to reach conclusion or reclassifying the nature of securitisation transaction, especially when the originator retains high level of risks in the assets.

The rating agencies examine each transaction and related documents where the transactions are proposed, in order to determine the appropriateness of the execution or executed documents. There are other roles of a credit rating agency which are important in securitisation.

The next section summarily highlights the failures of large entities which affected the investors and the economy in general.

IV. Usage of SPVs in high profile failures

Poor risks management and the misunderstanding of the risks associated with SPV usage has been a signification contributor in high profile failures. In this section we look summarily at some of the high-profile failures which had impacted the global economy.

- Towers Financial Corporation

The Towers Financial Corporation founded in early 1970s as a debt collection agency that was supposed to buy debts that people owed to hospitals, banks and phone companies which declared bankruptcy in 1994, is one of the classic examples of using SPVs to hide massive losses and overstated earnings. The Towers Financial Corporation raised over $ 400 million by selling bods and promissory notes to investors between 1988 and 1993. The money raised was the used to pay operating costs, repay earlier investors and to pay the associates and the founder. The funds were subsequently used towards the lavish lifestyle of the founder of the company Mr. Steven Hoffenberg. The Securities Exchange Commission charged the company of fraudulent reporting of profits for four years and later in March 1993 Towers Financial Corporation filed for bankruptcy protection.

The founder pleaded guilty in 1995 to five criminal charges and was sentenced in 1997 to 20 years in prison and was released after serving 18 years of sentence. In 2013 the court modified the terms of founders supervised release and imposed among other restrictions added a prohibition from engaging in direct contact with the victims. This case was also declared as the largest Ponzi scheme.

- LTV Steel Co.22

LTV Steel Co, one of the largest manufactures of wholly integrated steel products in the United States which produced flat rolled steel products, hot and cold rolled sheet metal etc. The asset backed securitisation transaction was commenced in October 1994 by Abbey National. A wholly owned subsidiary – LTV Sales Finance Co was formed, and an agreement was entered for sale of all its rights in accounts receivables to Sales Finance Co. Abby National obtained a security interest in those receivables in exchange for a $270 million loan to sales finance. In 1998, LTV entered into an ABS financing agreement in which LTV created LTV Steel Products, LLC. LTV the entered into agreement with Steel Products for sale of all its rights, title and interest in its inventory on continuing basis. Steel Products gave a security interest in its inventory to Chase Manhattan Bank and other banking institutions in exchange for a $ 30 million loan. LTV along with its 48 subsidiaries in 2000 filed voluntary Chapter 11 bankruptcies. The bankruptcy court passed the interim order allowing use of the accounts receivable sold to Sales Finance and the inventory sold to Steel Products so that LTV could continue its business operations. In this matter the court held that the originator could use assets that were sold and belonged to a bankruptcy remote SPV for its reorganization.

- Enron Corporation

Enron was incorporated in 1985 following a merger between Houston Natural Gas and InterNorth. In this case over 3,000 off balance sheet SPVs23 were created, many of which were designed for the purpose of asset securitisation. The SPVs were not illegal, however were different from standard securitisation in sever aspects. Enron kept hidden billions of dollars in debt from failed deals and projects from its investors to obtain lower cost of capital for the Originator. It tried to relinquish the risks through the SPVs, however, it remained as due to non-maintainability of sufficient level of corporate independence from the SPV. It manipulated the financial performance for artificially increasing the value of assets, accelerating profits and for avoiding debts on its balance sheet. It would transfer its own stock to an SPV in exchange for a note or cash. Enron would also guarantee the SPV’s value.24 The SPV, in turn, would hedge the value of a particular investment on Enron’s balance sheet, using the transferred Enron stock as the principal source of payment. Enron’s faulty assumption, however, was that the risk of having to pay on the guarantees was minimal based on the strength of its stock. However, when Enron’s stock price which had cascading negative effect on the SPV’s value. Enron’s stock price crashed, thus triggering the guarantee which in turn reduced the stock price. It even led to SPVs losing the independent equity. Enron also lacked sufficient assets to perform those hedges. Enron’s abuse of the process and fraudulent practices weakened huge investments in the asset backed securitisation transaction. On October 22, 2001, Enron announced that it was facing a Securities Exchange Commission probe and in November 2001, admitted that it was inflating its income since 1997. On December 2, 2001, Enron and certain other affiliated entities filed for bankruptcy under Chapter 11.

- Bear Stearns& Co.25

Bear Stearns was founded in 1923, the smallest of the top five investment banks on the wall street alongside the ranks of Goldman Sachs, Lehman Brothers, Merrill Lynch, and Morgan Stanley. It had survived the Great Depression; the stock market crash of 1987 and the terrorist attach of September 11. It had taken huge amount of exposure to mortgage-backed assets through special purpose fund. Bear Stearns in early 200’s earned profits from its aggressive stakes in collateralised debt obligations which were securities that contained thousands of adjustable-rate subprime mortgages. After the introductory period, the subprime mortgages shot up. Bear Stearns acquired three subprime originators and got a strong hold over the mortgage business.26 It increased its leverage when the firms were exiting the subprime sphere and was in trouble as early as June 2007, when two of its hedge funds imploded.

Bear Stearns problems increased due to deterioration of the subprime market due to which it attempted internal bailout of Rs. 3.2billion, however it was not enough. Eventually, in November 2007, Standard and Poor downgraded Bear Stearn’s mortgaged backed securities from AAA to A and in fourth quarter it reported its first ever loss of $327 million.

Bear Stearns went bankrupt and on March 13 the Federal Reserve of New York (the Fed) was notified that it did not have enough funding to cover its obligations and could not find a source of financing in the private sector as well. The Fed bailed out Bear Stearns with 12.9 billion credit line through JP Morgan Chase and created a limited liability company Maiden Lane LLC to purchase its illiquid assets, which would subsequently be sold to the Fed for $ 30 billion as its failure would lead to systemic risk to the financial system.

- Lehman Brothers Holdings, Inc.

The fourth largest U.S. investment bank in 2008, sought protection under Chapter 11 of the United States Bankruptcy Code in 2008, initiating the largest bankruptcy proceedings in the U.S. history. In the beginning of 2006, Lehman began to invest aggressively in real estate related assets and in a short period of time had significant exposure. Lehman failed even after taking desperate and questionable actions to stay alive as it was unable to finance itself. It highlighted the significant structural weaknesses in SPV documentation in relation to structured finance transactions leaving them with unforeseen.

V. Investor Protection

In a securitisation transaction there are several risks that an investor faces, which the SPVs need to anticipate understanding the potential concerns of investors. The concerns are usually taken care by the capital market regulator, though the investors should look beyond the rating assigned and engage in independent due diligence for their investment. The SPE/SPV typically has a fiduciary duty towards the investors to act in their best interest and empower them. The investors may be concerned with the following risks:

- Nature of the assets controlled by the SPV.

- Liquidity and solvency risk.

- Financial conditions of the Originator

- Credit Risk

- Servicing and commingling risk

- Market Risk and Legal Risk

- External credit enhancement

- Onerous contracts

- Consolidation of entities

VI. Legal and Regulatory framework in India surrounding securitisation and bankruptcy.

- Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002.

- Master Direction – Reserve Bank of India (Securitisation of Standard Assets) Directions, 202127.

- Reserve Bank of India (Securitisation of Standard Assets) Directions 28

- Reserve Bank of India (Transfer of Loan Exposures) Directions29.

- Master Circular on Asset Reconstruction Companies30.

- Securities and Exchange Board of India (Issue and Listing of Securitised Debt Instruments and Security Receipts) Regulations, 2008.

- Insolvency and Bankruptcy Code, 2016 (IBC) – It contemplates that the assets that are owned by third party but in possession of the corporate debtor due to any contractual arrangements (including bailment) or as a trust, those assets cannot be included in the assets of the corporate debtor during the corporate insolvency resolution or in the liquidation estate assets.31

- Insolvency and Bankruptcy (Insolvency and Liquidation Proceedings of Financial Service Providers and Application to Adjudicating Authority) Rules, 2019 (FSP Rules) 32

Other laws that impact the securitisation structures

- The Indian Trust Act, 1882

- Banking Regulation Act, 1949

- Income Tax Act, 1961

- The Indian Contract Act, 1872

- The Indian Stamp Act, 1899

- Foreign Exchange Management Act, 1999 and the rules and regulations thereunder.

VII. Courts decisions - Maintenance of bankruptcy remoteness

- Dewan Housing Finance Corporation (DHFL)

The bankruptcy proceedings against the housing company – DHFL on 2nd December 2019, as it was temporarily unable to transfer funds to the trusts and trustees due to unavailability of liquidity or cash collaterals. The Bombay High Court’s decision33 in this matter reversing its own prior decision, through which the DHFL was refrained from making payments towards its outstanding securitisation transaction, helped in maintaining the objective of the bankruptcy remoteness of Indian securitisation structures.

2. Union Bank of India on behalf of committee of creditors of Dewan Housing Finance Corporation Limited Vs. National Housing Bank and Anr.34

The Appellate Adjudicating authority enabled the, clarifies and strengthens the development of financial institutions by ring-fencing their loan receivables from the impact of insolvency. In this matter it was also observed that the DHFL received the financial assistance under the National Housing Bank Act, 1987 (NHB Act) could not be regarded as purely commercial as the National Housing Bank established under the NHB Act is a financial institution, therefore, it cannot be equated to the financial creditors of DHFL. The Section 238 of the IBC is important especially when the properties and assets belong to the debtor and not third party. The Union Bank filed an appeal seeking setting aside the order of the Appellate Adjudicating Authority that dismissed the appeal against the release of money, however the Apex Court directed the Union Bank to release “forthwith”35 to National Housing Bank.

VIII. Circumstances, situations, and elements where bankruptcy remoteness may be disrupted.

- Court orders for consolidation –The bankruptcy courts have the power to consolidate the SPVs with the originator. This would mean that the SPV would not be bankruptcy remote and as an effect the debts appear in the financial statements post consolidated as otherwise any debt incurred by the SPV does not appear on the Originator’s consolidated balance sheet36. The courts mainly rule in favour of consolidation when there is no existence of sperate legal entity or separateness between the Originator and SPV and at the time of investment, the investors may have relied upon the assets of the Originator.

- Challenge to securitisation transaction – The possibility of securitisation transaction being challenged cannot be excluded completely. It may occur if a creditor or third party of an insolvent originator seek to challenge the transfer of assets or the creation of legal isolation. An incorrect structure of the legal isolation may subject the SPE to insolvency or bankruptcy proceedings as well as challenging the securitisation structure like any other financial transaction.

- Fraudulent transactions – The Originator as stated in the above cases, used SPEs/SPVs for the purpose of defrauding, hid the debts, promised investors and public growth and earning, even when there are no real underlying earnings or assets to back the securitisation. These fraudulent transactions defy the objective of establishment of the SPVs. The credit quality of assets may not also be disclosed due to which they may not perform in a specified manner.

- Lack of transparency – The improper structuring of SPE/SPVs can lead to lack of transparency which can in turn make the process of risk mitigation unduly hard or cause complete disruption of bankruptcy remoteness.

- Regulatory risk – The SPE/SPVs assets attract different set of regulatory standards as compared to other types of entities. Any laxness in compliance of regulation may pose an indirect but serious risk to the Originator. The non-compliance may trigger certain punitive actions against the SPV/ the Originator.

- Credit enhancement -The SPV usually falls short of cash and is unable to fulfil its obligation to the investors due to the constrains on its business activities and limited debt incurring capacity. The Originators often retains certain residual interests in the SPV which provides a form of credit enhancement which in turn will preclude true sale. Credit enhancement can only be provided at the time of initiation of securitisation transaction and through securitisation notes, it can be made available throughout the lifetime of the SPV. Failure to maintain the required credit enhancement levels may result in default and the SPV may be required to take action in that regard.

- Tax issues -The SPVs are generally incorporated in tax heaven jurisdictions and are structured to be tax neutral so that the profits have minimal taxation in certain jurisdictions. The SPV does not achieve off balance sheet status for tax purposes whereas securitisations may be treated as secured financing for tax purposes.

- Liquidity risk– In case when an SPV is not able to perform, it may also affect the originator in accessing the capital market due to illiquidity.

- No restriction on SPV– In case the SPV is not restricted or prohibited to merge, consolidate, dissolve, liquidate or wind up or make amendments to its organisational structure it poses a risk.

IX. Consequences of disruption of bankruptcy remoteness

X. Mitigation of the risk of disruption of the bankruptcy remoteness

Establishment of an SPV, working under strict limitations and expectation to perform to achieve a specific purpose, it does come with certain risks. SPVs are remote. The best practice dictates that considering the fact that there would always be legal risks involved in securitisation, measures are often adopted to minimise the risk of disruption of bankruptcy remoteness.

- Prevent the SPV from becoming insolvent. In order to prevent the disruption of bankruptcy remoteness, focus should be on proper documentation which expressly limit the SPV’s authority due to which it is restricted to managing its own and business and securitised assets, collaterals. The SPE’s risk of insolvency can be reduced by constraining the SPE to only those activities that are needed to carry out the transaction generally at the arm’s length price which will reduce the likelihood of claims created by activities unrelated to the securitized assets and the issuance of the rated securities. In case the SPE engages in unrelated activities, it will affect not only the rating but also affect the cashflows, ability to pay interest and principal on the rated securities.

Further, an SPV must be limited in its acquisition of any additional debt to those that carry the same security rating as the asset backed securitisation.45 The SPV/SPE should appoint independent director to enable independent decision making and functioning and prevent comingling of risks with the originator. The governance process is also an important factor. The process should depend upon the complexity of structure and active intervention of various parties involved.

- Prevent the commencement of insolvency proceedings against SPV especially when the originator becomes insolvent. The SPV needs to take certain steps like (a) appointing independent director (b) The existence of agreements between the SPE and the creditor which include the non-petition language due to which the creditors agree not to initiate insolvency proceedings against the SPE and clauses which provide for non-joining of insolvency proceedings with third parties. The waivers can be classified into two categories for based on their type and scope –

A. Waivers issued by the creditors of SPV. The waivers issued by creditors of SPV is generally considered valid to the extent it is reasonable and is based on certain factors like, period of non-petition covenant, limiting the scope of the covenant to the extent of purpose and relevant transaction (after redeeming or repaying in full the securitised products). This measure in realistic sense may not be deemed valid especially, if anyone in violation of a waiver, files for the commencement of the insolvency proceedings, the SPE cannot request the court for rejection of the proceedings as the insolvency proceedings are believed to be in public interests. The SPE can only seek compensation for damages that occurred due to violation of the agreement. The benefit of enforceability of prepetition waivers of the right to seek bankruptcy protection or automatic stay has been a subject matter of substantial litigation. The courts have held that the agreement to not file bankruptcy for certain period is not binding.46 Although, in certain cases courts have allowed pre-bankruptcy waivers of automatic stay. They have laid down factors that the court needs to consider before enforcing the stay relief agreement47.

B. Waivers issued by the directors itself. The waivers made by the SPV, would against the public policy however in certain jurisdictions relying on certain exceptions, the courts may allow the waiver. The waivers issued by the directors themselves would be completely unenforceable as it would conflict their fiduciary duties and obligations.

- Protection of investors upon commencement of insolvency proceedings. To protect the interest of the investors upon commencement of insolvency proceedings of the SPV, creation of security rights can be a viable option. They may not get affected only in case when the proceedings are not initiated by the SPV and it is not a stock corporation and when corporate reorganisation proceedings are launched, otherwise they are subject to proceedings and the payments are made subject to the reorganisation plan. The intra-group guarantee is also one of the tools that is used which often take the form of contingent personal guarantees from the beneficial owners. These guarantees are enforced only in the circumstances when the SPE/SPV being the borrower takes certain actions prohibited in the guarantee.

- Assessment and reporting by the firms of the exposure in the SP in conjunction with other firm wide risks.

- Implementation of automatic stay to refrain the creditors/investors from foreclosing on the assets due to the difference in asset ownership48.

- Courts may give effect to limited recourse clauses if contractually agreed. Under Limited recourse investors have recourse only to the cash flows and assets in the securitised pool, which is achieved by the trust deed/documents defining the specific assets that form part of the trust estate, typically representing the securitised assets.

- Formation of an SPV and the relationship between the SPV and Originator is an important factor.

XI. Conclusion

The true potential of securitisation in select sectors like infrastructure, housing seems to be highly desirable. The SPV in order to remain or become attractive for the investors should be able to reach a wide variety of investors, this best practice will enable the SPV for achieving better credit ratings. In the Indian context the concept of bankruptcy remoteness in case of securitisation is clearly reflected in the intention of the Legislature through the laws framed (as provided under IBC). The existence of bankruptcy remote elements are the prerequisites for bankruptcy proofing. The bankruptcy remoteness during the corporate insolvency proceedings of the Originator under the IBC, would be set aside as avoidance transaction – preferential transaction49 or an undervalued transaction50.

Considering the high-profile failures (stated above), the notion of SPV being bankruptcy proof may be demolished. The Bankruptcy remoteness is, therefore, a malleable, fact-dependent concept and for achieving, it involves careful structuring to isolate the financial aspects. More efforts should be made to obtain legal opinions to establish better bankruptcy remoteness. Through this paper the author has tried to demonstrate that there is always a need to amend the prevailing regulations and policies like in India the concept of safe harbours under securitisation was brought in the FSP Rules and initiation of group insolvency/consolidation by the courts even at the time when it is pending implementation. Such proactive actions have also led to boosting investor confidence.

End Notes

- In this article the abbreviation SPE or SPV may be interchangeable used.

- As per Reserve Bank of India (Securitisation of Standard Assets) Directions, 2021, originator refers to “a lender that transfers from its balance sheet a single asset or a pool of assets to an SPE as a part of a securitisation transaction and would include other entities of the consolidated group to which the lender belongs”.

Inaugural speech by Mr R Gandhi, Deputy Governor of the Reserve Bank of India, at the “India Securitisation Summit 2015”, organized by the National Institute of Securities Markets (NISM), Mumbai, 14 July 2015 available at <https://rbi.org.in/scripts/BS_SpeechesView.aspx?Id=964>.

Master Direction Reserve Bank of India (Securitisation of Standard Assets) Directions, 2021.

Master Direction Reserve Bank of India (Securitisation of Standard Assets) Directions, 2021, SPE means “a company, trust or other entity organised for a specific purpose, the activities of which are limited to those appropriate to accomplish the purpose of the SPE, and the structure of which is intended to isolate the SPE from the credit risk of an originator”.

Saloman v Saloman Co. Ltd. 1897 AC 22; Lee v. Lee’s Air Farming Ltd. (1961) A.C. 12 (P.C.)

Tata Engineering & Locomotive Co. Ltd. v. State of Bihar, 1964 SCR (6) 885.

Note on Constitutional forms of SPVs in securitization transactions, Indian securitisation Foundation, available at<https://www.indiansecuritisation.com/images/21466485769.pdf>

As per Reserve Bank of India (Securitisation of Standard Assets) Directions, 2021, bankruptcy remoteness means “the unlikelihood of an entity being subjected to voluntary or involuntary bankruptcy proceedings, including by the originator or the creditors to the originator”.

Sale assailed: NBFC crisis may put Indian securitisation transactions to trial, available at <https://vinodkothari.com/2019/10/sale-assailed-nbfc-crisis-may-put-indian-securitisation-transactions-to-trial/> last accessed on 29.04.2024.

337 F.3d 951 (2003)

General Growth Properties Inc., 409 B.R. 43 (Bankr. S.D.N.Y. 2009).

Westlb AG v. Kelley, Bank of N.Y. Trust Co. v. Official Unsecured Creditor Comm (2014).

In re Jersey Tractor Trailer Training, Inc., the court summarized factors that are to be considered by other courts.

Standard & Poor’s Legal Issues in rating Structured Finance transactions: April 1998.

See Supra note 8.

As per Reserve Bank of India (Securitisation of Standard Assets) Directions, 2021, securitisation means “a structure where a pool of assets are transferred by an originator to a SPE and the cash flow from this pool of assets is used to service securitisation exposures of at least two different tranches reflecting different degrees of credit risk, where payments to the investors depend upon the performance of the specified underlying exposures, as opposed to being derived from an obligation of the originator.”

Steven L Schwarcz, Enron and the use and abuse of special purpose entities in corporate structures.

Securitisation in India: Ambling Down or Revving up? Inaugural Speech delivered by Shri R. Gandhi, Deputy Governor at “India Securitisation Summit 2015 available at<https://rbidocs.rbi.org.in/rdocs/Speeches/PDFs/SER150715388BF10066F34530883C2A51CDEE1504.PDF> last access on 21.04.2024.

It is basically an opinion of the credit rating agency that the issuer is likely to pay full principal and interest on the rated securities in a timely manner and in accordance with the terms and conditions.

In India the CRISIL Rating Limited, the wholly owned subsidiary of CRISIL Limited, an S& P Global company is registered as the credit rating agency with Securities and Exchange Board of India governed by Securities and Exchange Board of India (Credit Rating Agencies) Regulations, 1999.

- 274 B.R. 278, 279-80

- John A. Pearce II and Ilya A. Lipin, Special Purpose Vehicles in Bankruptcy Litigation, Hofstra Law Review available at<https://scholarlycommons.law.hofstra.edu/cgi/viewcontent.cgiarticle=2656&context=hlr> last accessed 29.04.2024.

- Report of investigation by the special investigative committee of the board of directors of Enron Corporation, available at <Report of investigation by the Special Investigative Committee of the board of directors of Enron Corp. | Request PDF (researchgate.net)>

- What happened to Bear Stearn? Who brought it? https://www.thestreet.com/personal-finance/bear-stearns Jul 21, 2023 10:02 AM EDT.

- Ibid

Chapter II, G. Conditions to be satisfied by the special purpose entity of Reserve Bank of India (Securitisation of Standard Assets) Directions, 2021.

Dated September 24, 2021, issued by the RBI.

Dated September 24, 2021, issued by the RBI.

Dated February 20, 2022, issued by the RBI.

Insolvency and Bankruptcy Code, s 18 and s 36.

The Insolvency and Bankruptcy (Insolvency and Liquidation Proceedings of Financial Service Providers and Application to Adjudicating Authority) Rules, 2019, includes the concept of safe harbours by excluding the insolvency effects. It enables enforcement of moratorium to bankruptcy remote transactions which in turn strengthens the bankruptcy remoteness.

Reliance Nippon Life Asset Management Limited Vs. Dewan Housing Finance Corporation Limited Ors. Interim Application No.1, 2 & 3 Of 2019 in Commercial Suit(L)No.1034 of 2019.

Union Bank of India on behalf of committee of creditors of Dewan Housing Finance Corporation Limited Vs. National Housing Bank and Anr., Company Appeal (AT) (Insolvency) No. 461 of 2021.

Financial standards, SC directs Union Bank to release over Rs 1,300 crore lying in its escrow account to NHB, https://www.financialexpress.com/business/banking-finance-sc-directs-union-bank-to-release-over-rs-1300-crore-lying-in-its-escrow-account-to-nhb-2665851/ last accessed on 22.04.2024.

Food Holdings Ltd. vs. Bank of America Corp. (In re Parmalat Sec. Litig.), 477 F. Supp. 2d 602, 609 n.45 (S.D.N.Y.2007).

- Insolvency Act 1986.

The US Bankruptcy Code.

Insolvency and Bankruptcy Code, s 3 (7) and (8).

Coeur Défense, Paris Commercial Court 3 November 2008, RG no 2008077996.

By an Order dated 26.02.2020, NCLT, Mumbai bench, in the matter of Lavasa Corporation Limited allowed the consolidation of the CIRP of its two subsidiaries.

Union of India v. Infrastructure Leasing & Financial Services Ltd., NCLAT order dated March 12, 2020 [Company Appeal (AT) No. 346 of 2018].

Order of first motion dated 21.03.204, available at <https://nclt.gov.in/gen_pdf.php?filepath=/Efile_Document/ncltdoc/casedoc/2709138121632023/04/Order-Challenge/04_order-Challange_004_1711022576646683665fc21f073146.pdf> last accessed on 22.04.2024.

Jaypee Kensington Boulevard Apartments Welfare Association & Ors. Vs NBCC (India) Ltd. & Ors. Civil Appeal No. 3395 Of 2020.

Johna. PearceH and Ilya A. Lipin, Special purpose vehicles in bankruptcy litigation.

In re Madison, 184 B.R. 686 (Bankr. E.D. Pa. 1995).

In re Bryan Road, LLC, 382 B.R. 844, 849 (Bankr. S.D. Fla. 2008).

Brent Truitt & Bennett J. Murphy, Bankruptcy Issues in Securitizations, in securitizations: legal and regulatory issues.

Insolvency and Bankruptcy Code s 43.

Insolvency and Bankruptcy Code s 45.

This article was originally published on 27th May 2024 in the Vikas Path: The Securitised Path to Financial Inclusion (compendium of shortlisted articles) for Wadia Ghandy Awards for Structured Finance Research published by Vinod Kothari Consultants and can be found at https://vinodkothari.com/2024/05/vikas-path-the-securitised-path-to-financial-inclusion/

*The author is a Research Assocaite and Team Lead, Insolvency Law Academy